Bitcoin hovering around $111,000, cryptocurrency mining remains a hot topic for investors, hobbyists, and businesses alike. But is it still profitable? The short answer: It depends. Factors like electricity costs (averaging $0.10–$0.15/kWh globally), hardware efficiency, market volatility, and regulatory changes play pivotal roles. While Bitcoin mining costs have soared past $100,000 per coin in some regions, efficient setups can yield returns—especially with Bitcoin’s price at $113,115 and mining costs at $115,098 as of early October. This ultimate guide breaks down profitability across key areas, drawing on real-time data, trends, and expert insights to help you decide if mining is worth it in 2025.

We’ll cover evergreen basics, current trends like post-halving economics, AI-integrated mining, and practical tips. Whether you’re eyeing Bitcoin, altcoins, or beginner-friendly options, this guide has you covered. Let’s dive in.

hp.comA typical Bitcoin mining rig setup using ASICs for high-efficiency operations.

Core Profitability Queries: Is Cryptocurrency Mining Still Profitable?

Cryptocurrency mining profitability in 2025 hinges on balancing rewards against rising costs. The Bitcoin halving in April 2024 reduced block rewards to 3.125 BTC, pushing miners toward efficiency. Yet, with Bitcoin’s price surge and transaction fees occasionally spiking, many operations remain viable. Here’s a deep dive.

Is Cryptocurrency Mining Still Profitable in 2025? A Beginner’s Guide

For beginners, mining can be profitable if you start small and smart. Basics include electricity costs (a major hurdle—expect $0.05–$0.20/kWh depending on location), hardware ROI (typically 6–18 months), and market volatility. In 2025, global hash rates have surged, making it harder for individuals, but tools like profitability calculators help. Real-world case studies show small-scale miners turning profits: One Reddit user reported 30–40% ROI after overheads, thanks to low electricity rates.

Top Factors Affecting Crypto Mining Profitability Today

Key factors in 2025: Energy prices (up due to global demand), halving events (Bitcoin’s reward cut increases scarcity), and regulations (e.g., U.S. incentives for green mining). Hashprice sits at $51/PH/day, with difficulty at all-time highs. Predictions suggest Bitcoin could hit $225,000 by year-end, boosting profitability.

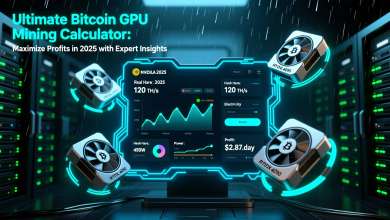

How to Calculate Cryptocurrency Mining Profitability Step-by-Step

Use formulas like: Daily Profit = (Hashrate × Block Reward × Coin Price / Network Difficulty) – (Power Consumption × Electricity Cost). Tools like WhatToMine or CoinWarz simplify this. Example: For a 100 TH/s ASIC at $0.10/kWh, Bitcoin mining might net $10–$20/day after costs, per current data. Customize for location-specific rates for accurate predictions.

2025 Cryptocurrency Mining Profitability Trends and Predictions

Trends show AI and HPC integration driving profits—Bitcoin miners earned $2.1 billion in Q2 2025. Altcoins like Grin and Iron Fish top profitability charts, though many show negative returns after electricity. Maximizing sustainability: Use renewable energy for 20–30% cost savings.

youtube.comHow do you service a 2500GPU Cryptocurrency Mining Farm – YouTube

Specific Crypto Focus: Crypto Mining Profitable in 2025 for Bitcoin and Ethereum?

Focusing on major coins reveals varied opportunities.

Is Crypto Mining Profitable in 2025? Expert Insights and Forecasts

Post-halving, Bitcoin mining favors large ops, but experts forecast profitability with BTC at $200,000+. Best coins: Bitcoin, Litecoin, and emerging like Kaspa. Overcome high energy costs with efficient hardware.

Is Bitcoin Mining Profitable for Small-Scale Miners?

For small miners, yes—if electricity is cheap (<$0.05/kWh). Break down: Solo vs. pool mining (pools reduce variance). Hardware like Antminer S21 series offers ROI analysis—expect $300–$500/month per machine. Sustainable strategies: Renewable energy cuts costs by 50%.

Ethereum Mining Profitability After the Merge: What Changed?

Ethereum mining ended with the 2022 Merge to PoS—no more GPU mining for ETH. Shift to alternatives like Ethereum Classic (ETC) or Ravencoin. Boost profits: Overclocking and software tweaks yield 10–20% gains. Vs. altcoins: ETC offers better ROI than many.

Hardware and Setup Variations: GPU vs. ASIC Mining Profitability

Hardware choice is crucial in 2025.

amazon.comAmazon.com: BITMAIN Antminer S19 86TH/S Bitcoin ASIC Miner(34J/T, 220V, 2967W, SHA256 Algorithm), High Hashrate/High Efficiency Air-Cooling Home Mining Machine for BTC/BCH/BSV w/o Power Supply : Electronics

Is GPU Mining Profitable in the Age of ASICs?

GPUs shine for altcoins like Ravencoin or Kaspa, but profitability is marginal—many setups show -$0.50/day after power. Build a rig: Budget ($1,000–$5,000) to high-end. Hacks: Software tweaks like Hive OS for efficiency.

ASIC Mining Profitability: Pros, Cons, and Top Models for 2025

ASICs dominate Bitcoin/Litecoin mining. Top models: Antminer S21 XP (270 TH/s, 13.5 J/TH). Pros: High hashrate; Cons: Noisy, expensive. Scaling for businesses: Industrial setups with financing. ASIC vs. GPU: ASICs win for BTC (up to 200% better ROI).

Alternative and Beginner-Friendly Approaches: Home and Cloud Mining Profitable?

Easier entries for newcomers.

Is Home Crypto Mining Profitable? Realistic Expectations for Hobbyists

Home mining can net passive income, but address noise/heat. Budget setups under $1,000: Use efficient ASICs. Balance costs: Expect $50–$200/month profit with low power rates.

Cloud Mining Profitability: Is It Worth It in 2025?

Cloud mining via platforms like NiceHash or Genesis offers no-hardware ease, but watch scams. Top services: Comparisons show 5–10% APR. Vs. hardware: Cloud suits beginners, with daily payouts.

Best Mining Profitability Calculators and How to Use Them

Top tools: WhatToMine (for altcoins), CoinWarz (BTC-focused). Advanced strategies: Factor in local rates for long-term planning. Tutorials: Input hashrate, power, and get instant estimates.

MINING

Is Cryptocurrency Mining Profitable in 2025? Ultimate Guide to Bitcoin, Ethereum Alternatives, GPU, ASIC, Home, and Cloud Mining