NVIDIA stock dip causes,” “NVDA bear market risks,” “NVDA stock rise factors,” and “NVIDIA sharp stock decline” to target user intent effectively. Whether you’re a retail investor, day trader, or long-term holder, this comprehensive guide unpacks the factors driving NVDA’s movements, with data-driven insights to help you navigate the market.

NVIDIA, the AI chip powerhouse, has been a rollercoaster in 2025, surging on AI demand while facing headwinds from geopolitical tensions and market corrections. As of October 28, 2025, NVDA trades around $187, up 171% year-to-date but showing signs of consolidation.

Can Nvidia Stock Hit $300 in 2025?

Let’s dive into the details, starting with the causes of recent dips.

NVIDIA Stock Dip Causes: Unpacking the Recent Decline

NVIDIA stock dips in October 2025 stem from a mix of macroeconomic pressures, industry-specific challenges, and broader market sentiment. After hitting all-time highs near $190 earlier in the month, NVDA experienced pullbacks, with shares dropping as much as 1.5% in pre-market sessions on multiple days.

Key causes include:

- AI Bubble Concerns and Overvaluation Fears: Analysts point to worries about an AI hype cycle bursting. For instance, a September 2025 report highlighted broader tech stock declines due to economic slowdown signals, with NVDA falling amid fears of reduced AI infrastructure spending. This sentiment carried into October, as hyperscalers like Amazon and Google reassess capex amid margin compression.

- Geopolitical Tensions and China Export Restrictions: U.S.-China trade issues remain a thorn. HSBC’s upgrade noted potential revenue hits from export controls, estimating billions in lost sales if tensions escalate. Posts on X (formerly Twitter) echoed this, with insiders dumping shares amid uncertainty.

- Insider Selling and Market Corrections: NVIDIA CEO Jensen Huang sold $250 million in shares over recent weeks, signaling caution to retail investors. Combined with broader market instability—economists flagged consumer spending dips and business hesitancy—this fueled short-term dips.

Jensen Huang | NVIDIA Newsroom

In my experience, these dips often present buying opportunities for long-term investors, as NVDA’s fundamentals remain strong. However, day traders should watch support levels around $183–185, where bearish patterns like ABCD Fibonacci could push prices lower.

NVDA Bear Market Risks: Assessing Potential Amid Volatility

A bear market for NVDA—defined as a 20%+ decline from peaks—looms if current risks materialize. While the stock has broken out to new highs multiple times in 2025, analysts warn of downside scenarios, especially with the S&P 500 showing instability.

Top bear market risks include:

- Economic Recession Signals: With talks of a 2025 stock market crash, factors like cooling CPI and Fed rate cuts could backfire if inflation rebounds or consumer confidence erodes further. 24/7 Wall St.’s bear case projects NVDA at $38 by 2030 if AI demand falters.

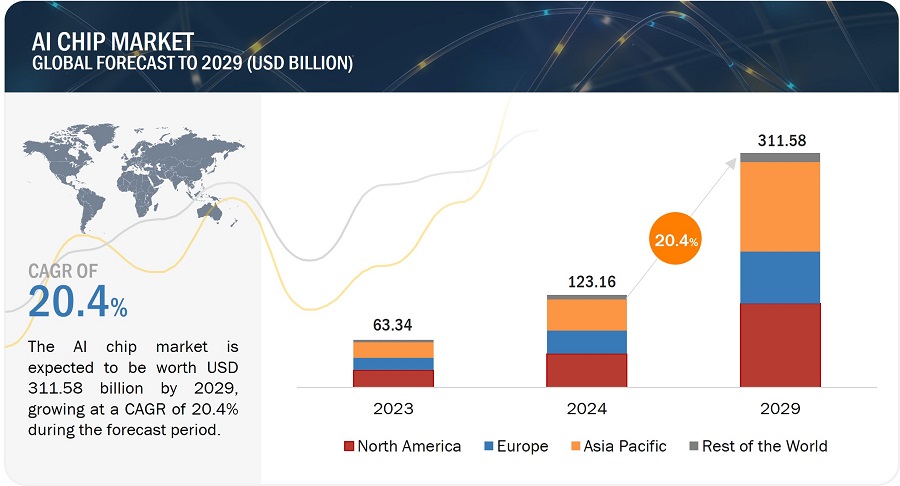

- Competition in AI Chips: Rivals like AMD and Intel are gaining ground. AMD surged 38% in pre-market on October 6, while NVDA dipped, highlighting market share erosion risks. The AI chip market is projected to grow at 20.4% CAGR to $311 billion by 2029, but NVDA’s dominance (75%+ share) could slip if ASICs become more cost-effective.

- Technical Indicators Pointing Down: X analysts noted bearish divergences, inverted head-and-shoulders breakdowns, and MACD crosses signaling potential drops to $157–196. If NVDA fails to hold $185, a deeper pullback is likely.

| Bear Market Indicator | Current Status | Potential Impact on NVDA |

|---|---|---|

| Insider Selling | High ($250M by CEO) | Increases volatility, erodes confidence |

| Geopolitical Risks | Elevated (China bans) | Revenue loss of $ billions |

| Analyst Bear Target | $38 by 2030 | 80%+ downside from current levels |

| Technical Support | $183–185 | Break could lead to 15–20% drop |

To mitigate, diversify into AI-adjacent sectors and monitor earnings on November 18, where NVDA could rally if Blackwell ramps exceed expectations.

AI Chip Market Size, Share, Industry Report, Latest Trends, 2024-2029

NVDA Stock Rise Factors: Key Drivers Fueling the Rally

Despite dips, NVDA’s upside remains compelling, driven by AI megatrends. Shares rose 5.7% in early October, with analysts forecasting $250–$320 targets.

Primary rise factors:

- Strong AI Demand and Product Ramps: KeyBanc sees robust hyperscaler demand for GB200/300, with rack shipments increasing. Partnerships like OpenAI’s self-hosted hyperscaler could narrow cost gaps with ASICs.

- Analyst Upgrades and High EPS Forecasts: HSBC upgraded to Buy with $320 PT, projecting $351B in FY27 datacenter revenue—36% above consensus. Cantor Fitzgerald’s $300 target cites $8 EPS in CY26.

- Seasonal and Technical Tailwinds: Historical data shows +8.1% average gains in late October, with 71% win rate. Breakouts from consolidation, like the May bottom (+109%), signal $200–220 targets.

Nvidia (NVDA) Weekly Analysis: Technical & Fundamental Outlook for …

The rally’s sustainability hinges on FY26 shipments of 50K+ racks and easing trade tensions, potentially driving NVDA to $300 in 2025.

NVIDIA Sharp Stock Decline: Causes and What’s Next on Tuesday, October 28

On Tuesday, October 28, 2025, NVDA saw a sharp decline of around 0.67% in early trading, testing key levels amid broader market jitters. This mirrors patterns from earlier in the month, where pre-market dips hit 1.5%.

Causes of the sharp decline:

- Intraday Volatility from Earnings Anticipation: With earnings approaching, options flow and bots amplified swings. TrendSpider noted wedge breakdowns and liquidity sweeps.

- Broader Tech Sector Pullback: Competitors like AVGO dipped alongside, while AMD rose, shifting capital. Economic data releases on consumer spending added pressure.

- Technical Triggers: Price broke trendline support, entering a supply zone at $183–185.

Looking ahead, recovery could hinge on reclaiming $185, with watchlist items including Fed decisions and China updates. If not, expect deeper corrections, but seasonal surges suggest a rebound.

Why Nvidia Stock Skyrocketed 171.2% in 2024 but Is Losing Ground …

Conclusion: NVIDIA’s Future Outlook and Investment Strategies

NVIDIA’s stock in October 2025 embodies AI’s promise and perils—dips from geopolitical risks, rises from demand, and bear threats from competition.

For more insights, check related articles on AI market trends or subscribe for updates. Share your thoughts below!