This piece draws on real-time market data, expert analyses, and substantiated insights to provide actionable value for investors searching for “NVIDIA stock drop reasons,” “NVIDIA price crash causes,” or “NVIDIA 16% peak fall.”

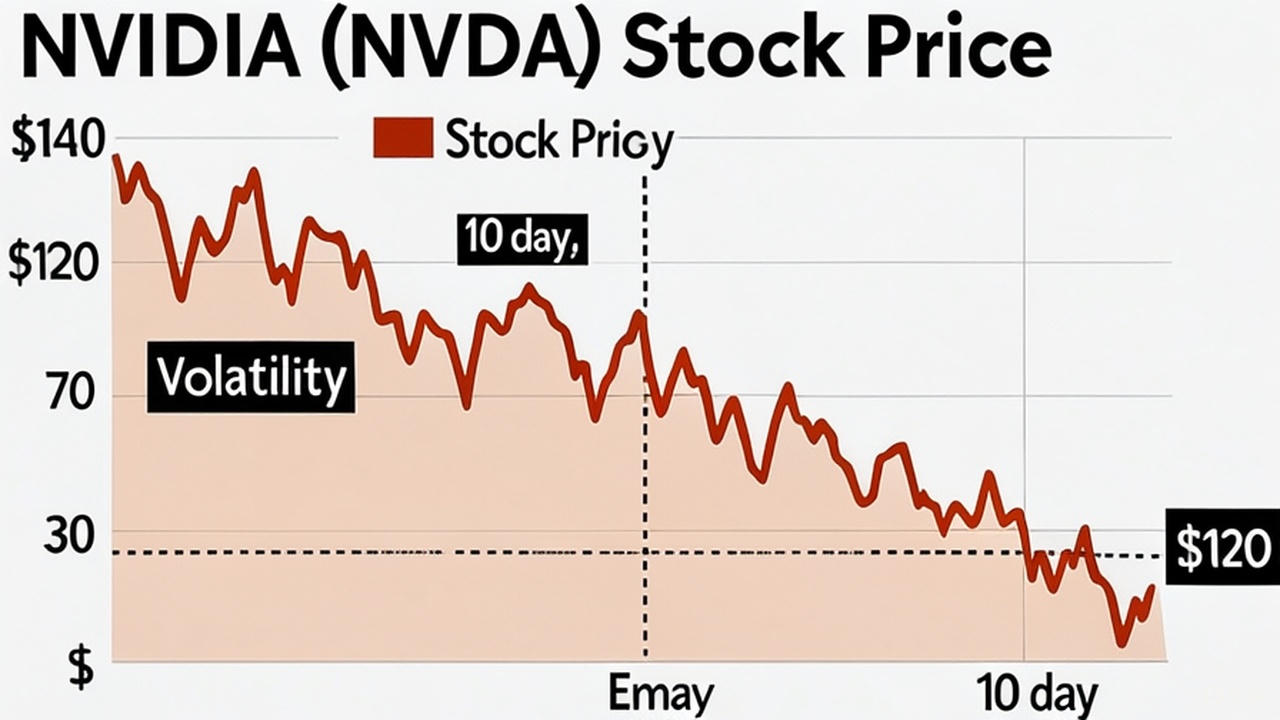

NVIDIA Corporation (NVDA), the powerhouse behind AI accelerators and GPUs, has been a Wall Street darling in 2025. Yet, despite a year-to-date surge of over 170% earlier in the year, the stock has faced volatility, including notable drops that have investors questioning its trajectory.

Why Nvidia Stock Skyrocketed 171.2% in 2024 but Is Losing …

As of October 28, 2025, NVDA trades around $191, recovering from recent dips but still 16% below its all-time high. In this detailed guide, we’ll decode the key factors behind these declines, explore historical comparisons, and offer forward-looking advice to help you navigate the market.

Understanding NVIDIA Stock Drop Reasons: Key Triggers in 2025

NVIDIA’s stock drops in 2025 stem from a mix of macroeconomic pressures, competitive threats, and sector-specific concerns. Unlike isolated events, these factors often compound, leading to broader sell-offs in tech stocks.

Geopolitical Tensions and Trade Policies

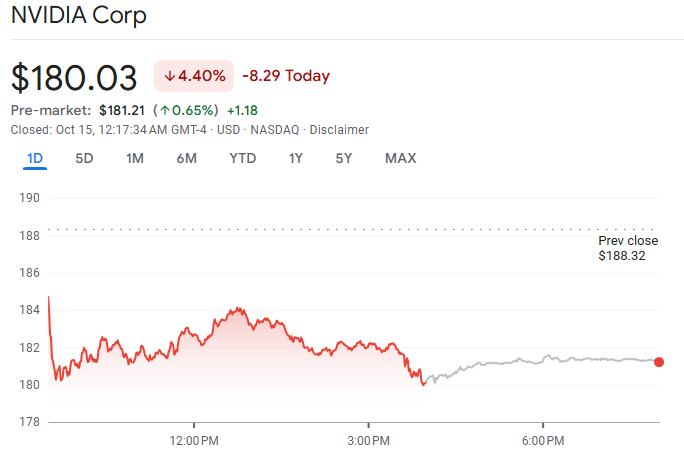

One of the primary NVIDIA stock drop reasons is escalating U.S.-China trade tensions. On October 10, 2025, NVDA fell nearly 5% after President Trump threatened additional tariffs on China, sparking fears of disrupted supply chains and reduced demand from a key market. China historically accounted for 20-25% of NVIDIA’s data center revenue, but U.S. export restrictions have slashed this to near zero, per CEO Jensen Huang’s statements. These curbs force China to pivot to domestic alternatives like Huawei’s Ascend chips, eroding NVIDIA’s dominance.

This isn’t new—earlier in 2025, similar restrictions contributed to a 20% year-to-date slump by April. Investors worry that further tariffs could amplify a broader tech sector downturn, as seen in a $770 billion wipeout in megacap tech values on October 10.

U.S. companies whose stock is most exposed to tariffs | Fortune

AI Market Saturation and Earnings Overreactions

Another core reason for NVIDIA stock drops is market overreaction to earnings and AI demand signals. Despite beating Q2 2025 expectations, NVDA dipped post-earnings due to concerns over peaking AI spending and client dependency. Reports of Oracle losing $100 million renting out NVIDIA’s Blackwell chips highlighted profitability challenges in AI infrastructure. This fueled fears of an “AI bubble,” with circular financing (e.g., NVIDIA funding OpenAI, which buys its chips) echoing the 2000 dot-com era.

Broader investor rotation out of AI-heavy stocks amid interest rate uncertainties has also played a role. As one X post noted, “If Nvidia crashes, we’ll see 1929 again,” reflecting sentiment around the stock propping up the market.

| Factor | Impact on NVDA Stock | Example Date |

|---|---|---|

| Trade Tensions | Reduced China sales, supply chain risks | Oct 10, 2025 (-5%) |

| Earnings Reactions | Overhyped expectations leading to sell-offs | Post-Q2 2025 |

| AI Bubble Fears | Profitability concerns in rentals | Ongoing 2025 |

NVIDIA Price Crash Causes: A Deep Dive into Geopolitical Risks and Market Shifts

Diving deeper into NVIDIA price crash causes, we see a pattern of geopolitical risks intersecting with rapid market shifts. In February and August 2025, NVDA experienced 16% weekly drops tied to Chinese AI startup DeepSeek’s low-cost, open-source models, raising fears of commoditized AI compute and eroded GPU demand.

Timeline of Key Crashes

- February 2025: DeepSeek’s advancements sparked initial “AI spending peak” worries, leading to a 17% drop.

- April 2025: Export curbs to China caused a 20% slump, with NVDA’s China market share plummeting from 95% to near zero.

- August 2025: Another DeepSeek release triggered a 16% fall, amid broader tech rotations.

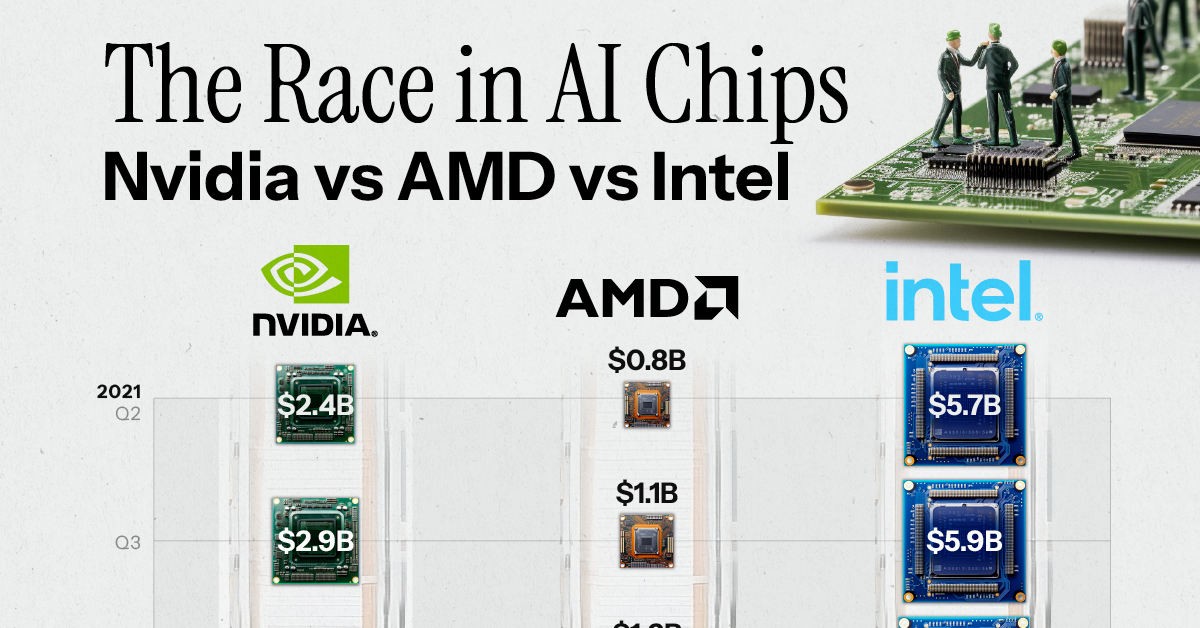

- October 2025: AMD’s multibillion-dollar deal with OpenAI for 6GW of chips led to a 1.8% drop on October 6, followed by a 4.4% decline amid competition fears.

NVIDIA vs. AMD vs. Intel: Comparing AI Chip Sales

Compared to past crashes, like the 2022 crypto downturn that hit NVDA hard, 2025’s issues are more about AI maturation than external shocks. Recovery strategies for traders include monitoring Blackwell ramp-ups and diversifying into resilient AI plays.

NVIDIA’s 16% Fall from Peak: Lessons from the DeepSeek Disruption and Beyond

The NVIDIA 16% peak fall in 2025, particularly in February and August, offers critical lessons. DeepSeek’s disruption highlighted vulnerabilities in NVIDIA’s high-end GPU monopoly, with investors fearing reduced demand as cheaper alternatives emerge. This led to a $ trillions market cap erosion across AI stocks.

Impact on Market Cap and Long-Term AI Outlook

From its peak, the 16% drop shaved billions off NVDA’s valuation, but the stock has rebounded to near highs by late October.

Why Is Nvidia Stock Going Down Today? Full Breakdown | EBC …

Long-term, Morgan Stanley projects a $3-5 trillion AI infrastructure market by 2030, with NVDA maintaining 80%+ share. However, bottlenecks like data center power (not chips) could slow growth.

Buy/sell recommendations: Hold for long-term AI believers, but sell if tariffs escalate. KeyBanc sees upside to $250 on strong demand.

Expert Opinions on NVIDIA’s Volatility

Experts like those at Barron’s and Yahoo Finance attribute drops to short-term noise amid robust fundamentals. Jensen Huang emphasizes AI’s “embryonic phase,” with agentic AI driving future demand. On X, analysts warn of bubble risks but note NVDA’s moat in full-stack architecture.

Future Predictions and Investment Advice

Looking ahead, NVDA could hit $250 by 2026 if Blackwell shipments exceed 50K racks. Risks include AMD’s gains and AI efficiency gains reducing GPU needs.

NVIDIA | Projects | Gensler

In conclusion, while NVIDIA stock drop reasons like trade tensions and competition have caused volatility, the company’s AI leadership suggests resilience. Stay informed with tools like Yahoo Finance or X for real-time updates.