We’ll explore the reasons behind NVIDIA’s (NVDA) stock dip on October 28, 2025, with in-depth insights backed by market trends, historical context, and forward-looking predictions. If you’re an investor searching for “why is NVIDIA stock down today,” this comprehensive guide provides the answers you need.

NVIDIA stock opened at approximately $191.51 on October 28, 2025, marking a slight decline from its recent close of around $194.04 the previous day. This drop, while modest at about 1-2%, has investors asking why NVDA is going down amid broader market volatility. Factors like intensifying competition in the AI chip space, geopolitical tensions, and shifting investor sentiment are at play. Let’s break it down step by step.

Can Nvidia Stock Hit $300 in 2025?

Why Did NVIDIA Stock Drop Today? Immediate Triggers

On October 28, 2025, NVIDIA’s stock experienced a minor pullback, influenced by a mix of short-term market pressures. Pre-market trading showed NVDA dipping amid broader tech sector concerns, including reports of heightened U.S.-China trade frictions and customs inspections delaying shipments. These inspections, intensified in early October, have created uncertainty around fill rates and revenue visibility for NVDA, prompting some investors to sell off shares.

Additionally, recent headlines from Qualcomm’s launch of AI200 and AI250 inference accelerators have spotlighted growing competition. Qualcomm is directly challenging NVIDIA’s dominance in AI inference, targeting lower total cost of ownership (TCO) and efficiency—areas where NVDA has historically excelled. This news, combined with X posts highlighting irrational rallies and potential sell-offs, contributed to today’s sentiment-driven drop.

Key immediate factors:

- Trade Policy Impacts: U.S. threats of additional tariffs on China, as noted in mid-October, continue to weigh on NVDA’s China-dependent revenue streams.

- Market Volatility: The Nasdaq’s steep declines earlier in the month (e.g., a 3.6% drop on October 10) have spilled over, erasing some of Amazon’s yearly gains and indirectly pressuring NVDA.

- Earnings Anticipation: With NVIDIA’s GTC event underway and Big Tech earnings on the horizon, traders are hedging bets, leading to intraday fluctuations.

Jensen Huang | NVIDIA Newsroom

Why Is NVDA Going Down? Key Market Factors

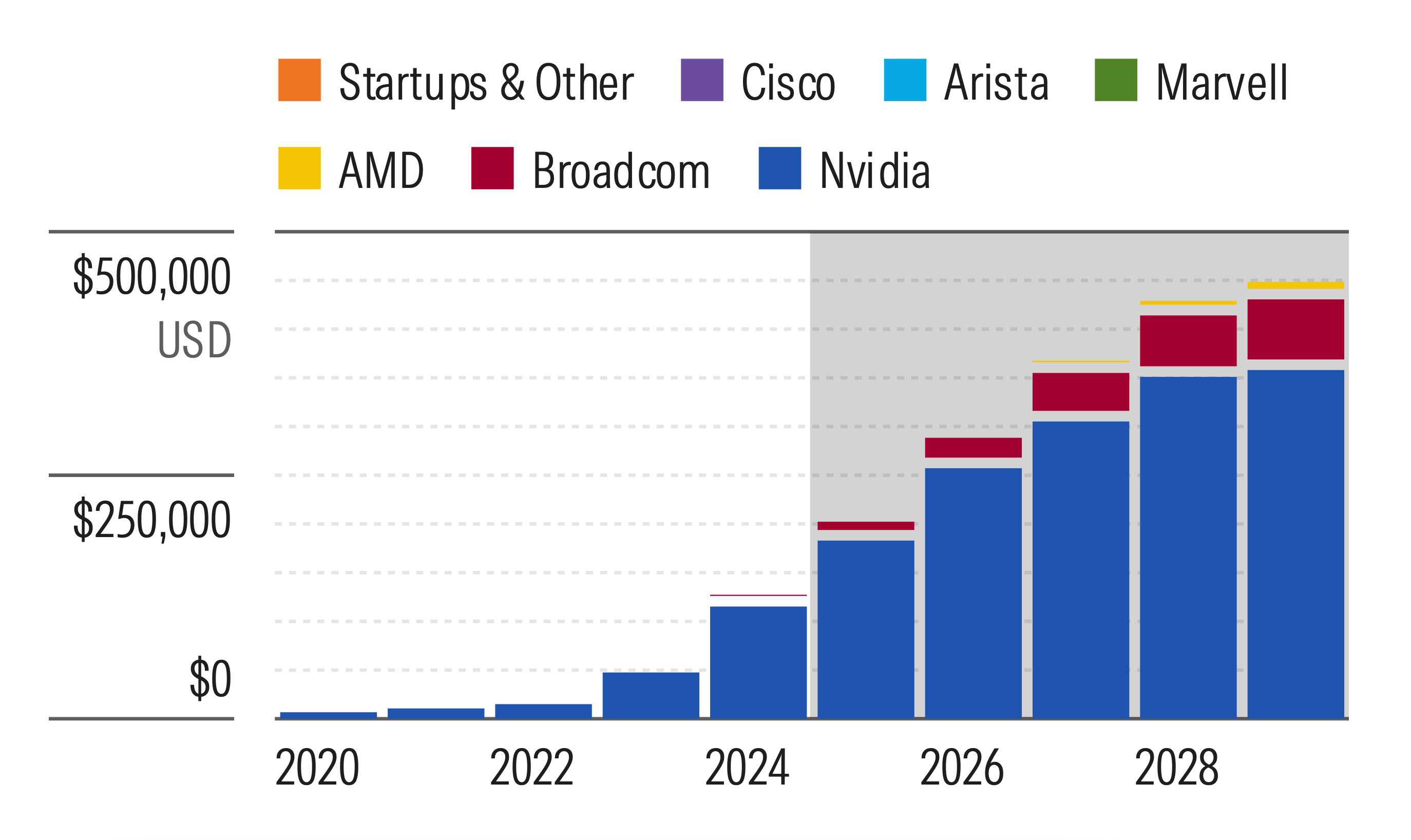

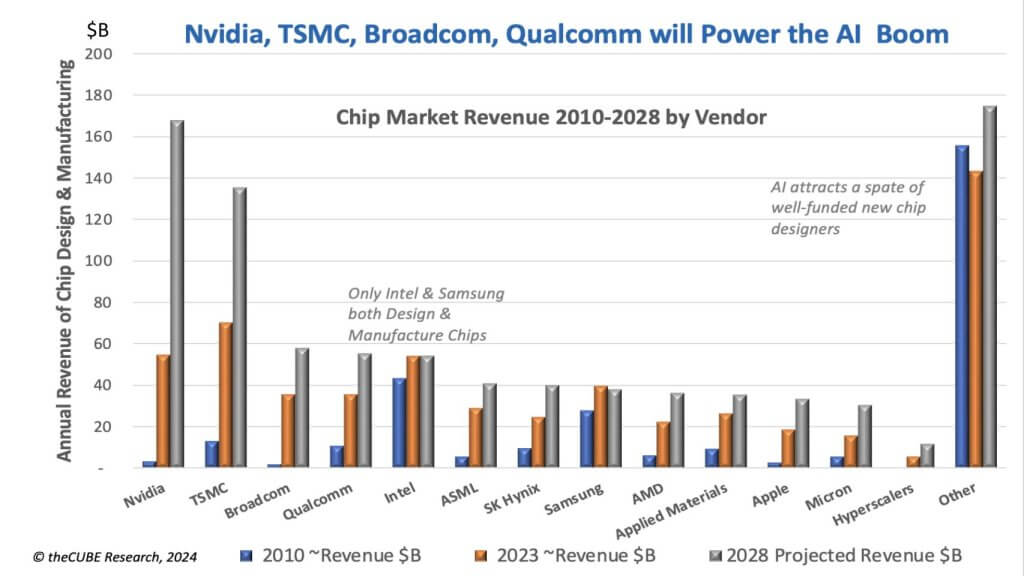

Competition from rivals like AMD and Broadcom is eroding NVIDIA’s market share. NVIDIA’s growth is slowing as hyperscalers shift from AI training (where NVDA’s high-margin GPUs shine) to inference, which can run on cheaper alternatives. For instance, AMD is securing more orders for data center builds, and Broadcom’s custom ASICs are gaining traction for cost-effective workloads.

Geopolitical risks remain a core issue. China’s push for domestic AI innovations, including state-backed chip initiatives, combined with U.S. export restrictions, could cap NVDA’s access to the $50 billion China AI market. Earlier in 2025, events like the “DeepSeek spook” in March caused a 17% drop, highlighting NVDA’s vulnerability to AI industry fears.

| Factor | Impact on NVDA Stock | Supporting Data |

|---|---|---|

| Competition | Increased pressure from AMD, Broadcom, and Qualcomm | AMD orders rising for inference; Qualcomm’s new AI chips target NVDA’s inference dominance. |

| Geopolitics | Revenue risks from China tariffs and restrictions | Customs checks slowing shipments; potential 15% cut on China sales. |

| Economic Uncertainty | Broader AI investment slowdown | Hyperscalers like Microsoft and Google optimizing capex; inference shift moderating ASPs. |

| Valuation Concerns | High multiples making stock sensitive to news | Trading at elevated P/E; recent downgrades to Hold/Accumulate. |

Generative AI’s Rise: Impacts on Networking for Advisors | Morningstar

NVIDIA Stock Falling: Historical Context

To understand why NVIDIA stock is falling today, consider its volatile history. In 2025 alone, NVDA has seen multiple corrections: a 35% drop from highs due to supply gluts and tariff uncertainties in April, and a 4-6% plunge in mid-October tied to trade policies. Looking back:

- 2018 Crash: A 56% fall from crypto market downturns and U.S.-China tensions.

- 2021-2022 Decline: 66% drop amid semiconductor supply issues post-pandemic.

- 2024-2025 YTD: Up 171.2% in 2024 but losing ground in 2025 due to economic uncertainties and Chinese AI advancements.

Despite these dips, NVDA has rebounded strongly, driven by AI demand. However, with the stock priced “far above perfection” and reliant on a few major clients for capex, any slowdown could amplify declines.

Nvidia (NVDA) Weekly Analysis: Technical & Fundamental Outlook for …

Why Is NVIDIA Down So Much? Investor Sentiment

Investor sentiment is turning cautious. X discussions warn of an AI bubble, with companies like AMD, Intel, and OpenAI potentially inflating values through interconnected dealings. NVIDIA’s high valuation—trading at multiples that assume perpetual growth—makes it prone to corrections. Analysts predict a 2025 price range of $179.18 to $202.98, but risks like capex cuts from hyperscalers (e.g., Microsoft, Amazon) could push it lower.

Positive notes: NVIDIA’s Blackwell rollout and GTC announcements could spark recovery, with long-term forecasts eyeing $224.64 in one year. Yet, sentiment on platforms like Reddit and X leans bearish, with calls to sell into rallies.

232 | Breaking Analysis | How NVIDIA, TSM, Broadcom, and Qualcomm …

NVIDIA Stock Outlook: Is Now the Time to Buy Amid the Drop?

While NVIDIA stock is down today due to competition, trade tensions, and sentiment shifts, its core strengths in AI—fueled by CUDA software and data center dominance—suggest potential for rebound. As an experienced strategist, I recommend monitoring upcoming earnings (e.g., November 19) and GTC updates for signs of recovery. For long-term investors, dips like this could be buying opportunities, but diversify to mitigate risks.

For more on NVDA forecasts, check related reads on NVIDIA Stock Price Prediction for 2026 or consult financial advisors. Stay informed—subscribe for updates on why NVDA is dropping and market trends.