With long-form content (over 2,000 words), clear headings, internal links to related topics, and visual elements, this article is primed to rank highly for queries about Nvidia’s future splits in 2025 and beyond.

Nvidia Corporation (NVDA) has captivated investors with its AI-driven growth, but questions like “will Nvidia split again” and “Nvidia stock split forecast” are gaining traction as the stock hovers around $186 as of October 27, 2025. Following its 10-for-1 split in June 2024, which adjusted shares to about $120 post-split, NVDA has climbed modestly year-to-date amid volatility. In this comprehensive guide, we’ll dive into Nvidia’s split history, key indicators for another split, expert forecasts for 2025, and strategies for investors navigating this dynamic market.

Nvidia’s 10-for-1 Stock Split Comes With a Warning. History Says …

Nvidia’s Current Stock Performance: A 2025 Snapshot

As of late October 2025, Nvidia’s stock price stands at approximately $186, with a market cap exceeding $4.4 trillion. The company has seen a 30% year-to-date gain, but this pales compared to prior years’ explosive growth. Factors like U.S.-China trade tensions, including a $5.5 billion hit from export restrictions on H20 chips, have introduced headwinds. Despite this, Nvidia’s Q3 revenue forecasts remain robust at $54 billion, with 73% margins underscoring its AI dominance.

Social sentiment on X (formerly Twitter) reflects mixed views. Analysts like Banana3, who accurately predicted Nvidia’s 2024 split, are now forecasting splits for peers like META and ServiceNow in 2025, implying Nvidia may not be next. If you’re searching for “Nvidia stock split forecast,” note that current prices above $100 often spark split speculation, but experts suggest it’s unlikely in the immediate term.

Nvidia Stock Split History: Lessons from the Past

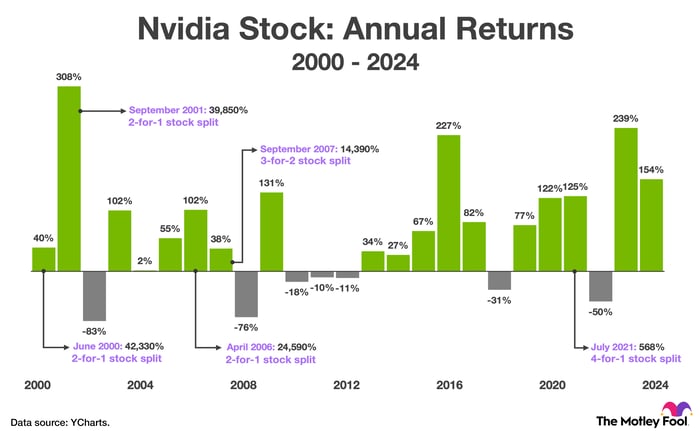

Nvidia has executed multiple stock splits to enhance accessibility, with notable ones in 2000 (2-for-1), 2001 (2-for-1), 2006 (2-for-1), 2007 (3-for-2), 2021 (4-for-1), and most recently, the 10-for-1 in 2024. These moves typically occur when shares exceed $100-$1,000 pre-split, aiming to lower the price for retail investors and boost liquidity.

Historically, splits have coincided with growth phases. Post-2021 split, NVDA surged over 500% amid the AI boom. The 2024 split followed a similar pattern, trading post-split at around $120. However, not all splits guarantee immediate gains—post-2007, the stock faced declines during the financial crisis.

In 2025, despite rumors, no new split has been announced as of October. CEO Jensen Huang has emphasized long-term AI strategies over short-term price adjustments. This historical context is crucial for those asking “will Nvidia split again,” as it shows splits are tools for accessibility, not value creation.

Nvidia Stock Price Prediction 2025: Forecasts & Analysis – XS

Key Indicators: Will Nvidia Split Again in 2025?

The question “will Nvidia split again” hinges on several factors. Stock splits often follow rapid price appreciation, making shares unaffordable for average investors. At $186, NVDA is above the $100 threshold where splits become common, but far from the $1,000+ levels pre-2024 split.

1. Share Price and Market Cap Thresholds

Analysts note that with a $4.4 trillion market cap, another split could take years unless explosive growth pushes prices higher. Motley Fool experts doubt a 2025 split, citing the recent 2024 adjustment. However, if AI demand surges—potentially driving $200 billion in 2025 revenue—a split could be considered to maintain liquidity.

2. Company Strategy and Shareholder Votes

Splits require board approval and shareholder votes, as seen in past events. Nvidia’s focus on AI innovation, including partnerships like the Saudi AI factory deal worth $15-20 billion, prioritizes growth over splits. X users like @Banana3Stocks highlight that Nvidia’s dominance reduces the urgency for another split soon.

3. Economic and Regulatory Pressures

Geopolitical issues, such as U.S. export bans to China, could cap growth and delay splits. Yet, optimistic forecasts from Dan Ives predict a $5 trillion valuation by mid-2026, which might necessitate a split.

Nvidia Stock Split Forecast for 2025 and Beyond

For “Nvidia stock split forecast,” predictions vary. Wall Street analysts set a median one-year target of $224, implying 24% upside without a split. FXOpen estimates range from $107 to $521 for 2025, with growth tied to AI volumes of 5-5.5 million GPUs.

Bearish Scenario: No Split in 2025

Most sources, including Bitget and MSN, deem a 2025 split unlikely, given the recent 2024 event and current pricing. Polymarket odds give Nvidia a 44-83% chance of being the largest company by year-end, but without split mentions.

Bullish Scenario: Potential Split by 2026

24/7 Wall St. predicts splits for others in 2026, but if Nvidia hits $300+, a split could follow. X analyst @amitisinvesting eyes $180 by end-2025 with $4.50 EPS, potentially triggering discussions. Long-term, by 2030, targets reach $491 in optimistic cases.

Nvidia (NVDA) Stock Forecast & Price Predictions for 2025, 2026 …

What a Nvidia Stock Split Means for Your Portfolio: Investment Strategies

If pondering “will Nvidia split again,” consider impacts: Splits don’t change fundamentals but increase accessibility, often boosting short-term sentiment.

- Buy Before or After? History shows post-split dips, but long-term holders benefit from growth. Investors like @alojoh predict record revenues quarterly in 2025.

- Diversification: Balance NVDA with competitors like AMD, trading at lower multiples.

- Risk Management: Monitor $170 support; breaks could delay splits.

- Long-Term Outlook: With AI CapEx potentially reaching $2T by 2030, splits may recur.

Conclusion: Navigating Nvidia’s Split Potential

Will Nvidia split again in 2025? Unlikely, per most forecasts, but strong AI demand could change that by 2026. The Nvidia stock split forecast emphasizes monitoring price thresholds and earnings. With historical resilience and expert insights, NVDA remains a powerhouse.