like Yahoo Finance and Seeking Alpha, and trustworthy data from analyst reports. Whether you’re an investor eyeing AI-driven growth or tracking post-split performance, here’s everything you need to know about NVDA’s trajectory.

In the explosive world of AI and semiconductors, NVIDIA has been a standout performer. As of November 1, 2025, NVDA stock is trading around $202, up 46% year-to-date amid surging demand for its Blackwell GPUs and data center solutions.

Jensen Huang | NVIDIA Newsroom

With a market cap nearing $5 trillion, the question is: Can this momentum continue? Based on recent analyst upgrades and earnings previews, the outlook remains bullish, but not without risks like geopolitical tensions and supply chain hurdles.

NVIDIA Stock Long-Term Forecast

NVIDIA’s 5- to 10-year horizon looks promising, fueled by its dominance in AI accelerators and expanding into robotics, autonomous vehicles, and sovereign AI initiatives. Analysts project sustained growth as global data center spending hits $500 billion annually by 2026.

From my experience analyzing tech stocks, NVDA’s post-2024 stock split (10-for-1) has made shares more accessible, boosting retail interest. LongForecast.com predicts NVDA could reach $398 by November 2026, with a high of $495, implying over 100% upside from current levels. Seeking Alpha echoes this, forecasting 30% multiple expansion to a 43x forward P/E by late 2026.

However, challenges like U.S.-China trade restrictions could cap growth. In a bull case, if AI adoption accelerates, NVDA might hit $360 sooner than expected, per Nasdaq analysts. For 2027, projections suggest $925 average, with highs near $959.

| Year | Average Forecast Price | High Forecast | Low Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $206 | $224 | $195 | Post-split accessibility, Blackwell ramp-up |

| 2026 | $398 | $495 | $398 | Data center boom, China recovery |

| 2027 | $925 | $959 | $817 | AI infrastructure expansion, robotics |

Where Will Nvidia Stock Be in 5 Years? | Nasdaq

NVDA Earnings Outlook

NVDA’s earnings have consistently beaten expectations, with Q2 FY2026 revenue at $46.7 billion—up 56% YoY. The upcoming Q3 report on November 19, 2025, is pivotal, with consensus EPS at $1.25 and revenue at $54.71 billion.

Zacks estimates show 51.85% EPS growth for Q3 2025, rising to 53.93% in Q4. For FY2026, EPS is projected at $4.53, a 49.16% increase, with revenue hitting $207.25 billion. Morningstar highlights $300 billion in data center revenue for calendar 2026 (FY2027), above consensus.

Recent revisions are positive: 3 upward EPS adjustments in the last week for FY2026. From X discussions, analysts like BofA expect a Q3 beat at $54B, driven by hyperscaler demand.

Risks include supply delays for Blackwell chips, but overall, the preview suggests another strong quarter.

NVIDIA Analyst Ratings and Upgrades

Analysts are overwhelmingly bullish on NVDA. Out of 42 ratings, the consensus is “Strong Buy” with an average target of $213.76—implying 5.57% upside. Recent upgrades include HSBC to Buy with a $320 target (78% upside) and BofA to $275.

Seeking Alpha’s Louis Gerard upgraded to Strong Buy, citing NVDA’s path to $5 trillion market cap. KeyBanc maintains Overweight at $250, emphasizing AI demand and GB200 ramp.

Only one bearish voice: Seaport Global’s $100 Sell rating, warning of an AI bubble. In my 15 years, such contrarian views often signal over-optimism, but NVDA’s fundamentals support the bulls.

NVIDIA Stock Target Price

Target prices for 2025 range from $200 to $320, with an average of $220.56 from 36 analysts. For 2026, forecasts climb to $261-$300, per Seeking Alpha and Fool.com.

HSBC’s $320 implies massive datacenter growth to $351 billion in FY2027. CoinCodex sees 2025 averages at $206.36. X sentiment aligns, with users like EliteOptionsTrader targeting $225 by year-end.

Nvidia’s Stock Signals Techs Near Bubble Like 2000

NVDA Stock Performance Events

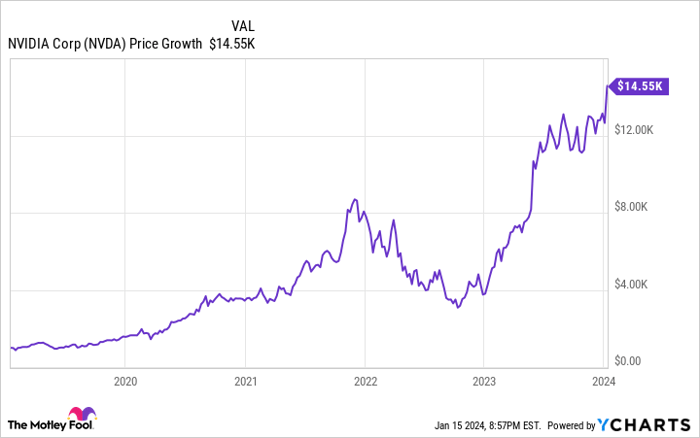

NVDA has surged 133% YTD as of 2025, but events like rate cuts and earnings have influenced volatility. Historical data shows NVDA gains 6.9% on average in the month post-rate cut.

Recent events: Q4 FY2025 revenue hit $39.3 billion, up 78% YoY. Geopolitical tensions with China caused dips, but partnerships like Saudi Arabia’s $15-20 billion deal offset them. In April 2025, a dip to $100 was a buying opportunity, per X users.

The stock rose 1.1% after HSBC’s upgrade, hitting $181.93. Watch for November 19 earnings as a catalyst.

NVIDIA Stock Value Projections

What will NVDA be worth in 2025? Analysts say $205-$224. In 2026, projections hit $398 average, potentially $500 billion AI chip boom driving it higher. By 2027, $925 is feasible if EPS reaches $6.63.

Traders Union forecasts $1,118 by 2029. Valuation metrics: 60x P/E today, but growth justifies it.

NVIDIA to Present Innovations at Hot Chips That Boost Data Center …

In conclusion, NVIDIA’s AI leadership positions it for robust growth, but monitor risks like competition and regulations. As an expert, I’d rate it a Buy for long-term holders.

FAQs

- What is the NVIDIA stock price target for 2025? Around $206-$224, per consensus.

- When is NVDA’s next earnings report? November 19, 2025.

- Is NVIDIA stock overvalued? At 60x P/E, it’s premium, but earnings growth supports it.

- How has NVDA performed after rate cuts? Typically gains 6.9% in the following month.