As of November 3, 2025, Advanced Micro Devices (AMD) stock is trading around $256, showing remarkable resilience in a volatile semiconductor market driven by AI demand. With partnerships like the massive OpenAI deal and surging data center revenue, investors are keenly eyeing AMD stock price prediction, forecast, and targets. This comprehensive guide breaks down key insights, drawing from analyst reports, market trends, and recent earnings expectations to help you decide if AMD is a good stock to buy now.

AMD Stock Price Prediction

AMD’s stock has more than doubled in 2025, fueled by AI chip advancements and strategic wins. Analysts project continued growth, with fiscal 2025 earnings climbing 20% year-over-year to $3.14 per share, potentially surging 64% to $5.16 in fiscal 2026. For November 2025 specifically, predictions indicate an average price of $280, with a maximum of $330 and a minimum of $228. This optimism stems from AMD’s Instinct GPUs positioning it as a viable alternative to NVIDIA in AI infrastructure.

Short-term predictions hinge on the Q3 earnings report on November 4, where a huge order backlog could trigger a stock surge. Looking ahead, AI server demand and partnerships like OpenAI’s multi-year agreement could drive shares toward $300 by year-end. However, risks include competition and margin pressures from R&D costs.

For a visual overview of AMD’s performance:

AMD stock news today: What will AMD stock be worth in 2025 …

Longer-term, if AMD maintains 15% margins by 2030, it could quadruple in value, implying annualized gains of 32%. Historical performance supports this: AMD’s EPYC processors and AI PCs are becoming standards in data centers and on-device inference.

AMD Stock Price Forecast

The near-term forecast for AMD remains bullish, with Q3 2025 revenue expected to spike 28.3% year-over-year to $8.75 billion and EPS at $1.17. Analysts anticipate 19.14% EPS growth for the full year 2025, accelerating to 60.29% in 2026. Revenue projections stand at $33.09 billion for 2025, rising to $42.18 billion in 2026.

Key drivers include:

- Data Center Strength: MI325X chips are selling out amid hyperscaler demand.

- Government and Enterprise Wins: U.S. Department of Energy integrations and expanded TSMC capacity for EPYC chips.

- Economic Factors: Inflation and semiconductor supply chains could influence volatility, but AI boom offsets risks.

Over the next 12 months, forecasts suggest prices between $256 and $317, with potential for bullish or bearish swings based on earnings. Recent X sentiment echoes this, with users predicting $250 by end-2025 if AI momentum holds.

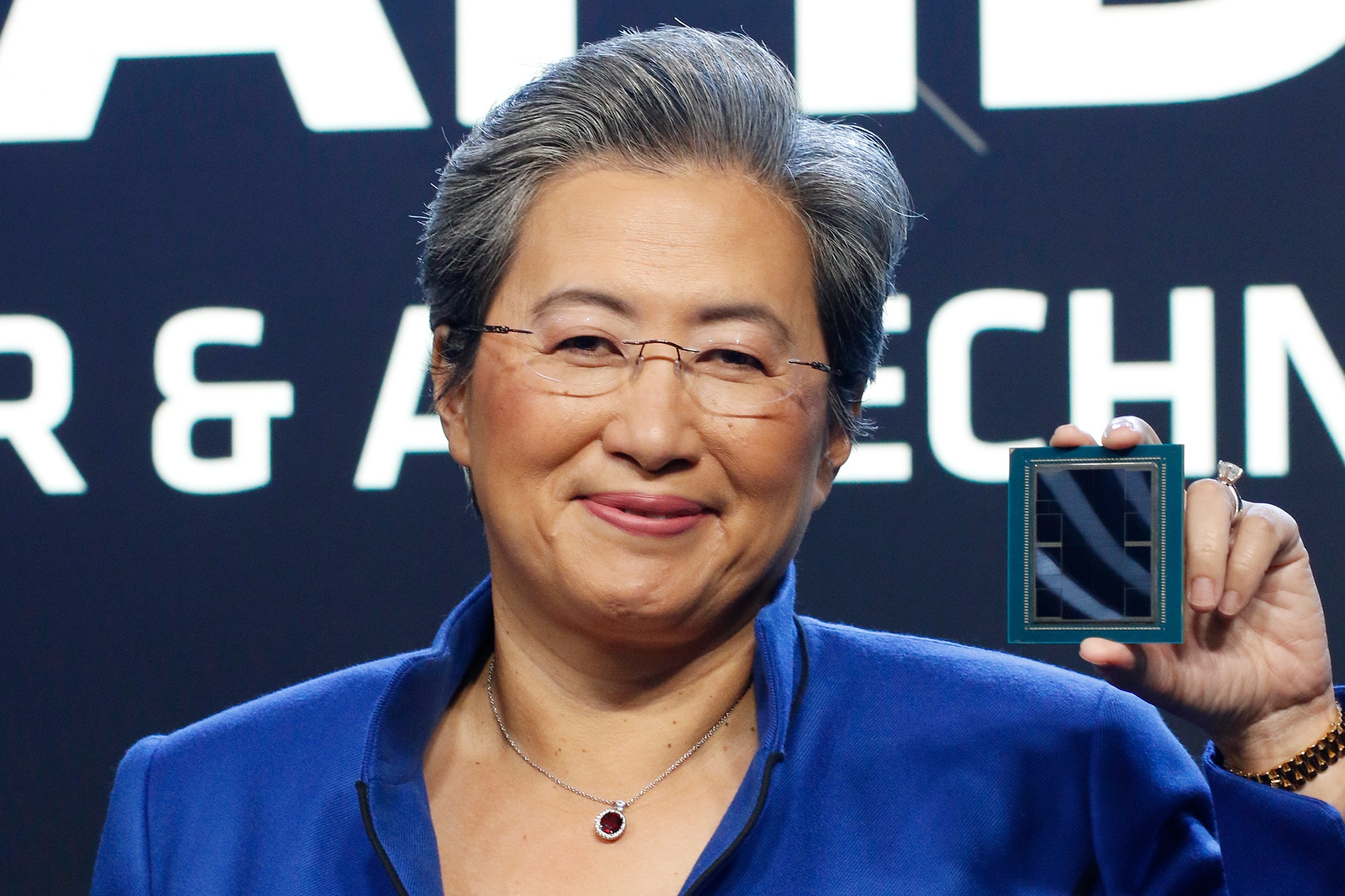

Under the leadership of CEO Dr. Lisa Su, AMD is executing on its roadmap effectively.

Dr. Lisa Su – AMD Chair and Chief Executive Officer

AMD Stock Price Target

Analyst consensus sets the average 12-month price target at $245.67, with a high of $310 and low of $166. This represents a modest upside from current levels, but recent upgrades signal stronger potential. For instance, Susquehanna raised its target to $300 from $210, implying 15.96% upside.

Here’s a breakdown of recent analyst targets:

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Susquehanna | Positive | $300 | Oct 31, 2025 |

| Morgan Stanley | Equalweight | $246 | Oct 7, 2025 |

| Piper Sandler | Overweight | $240 | Oct 7, 2025 |

| Jefferies | Buy | $300 | Oct 7, 2025 |

| Barclays | Overweight | $300 | Oct 7, 2025 |

| Cantor Fitzgerald | Neutral | $275 | Oct 7, 2025 |

| Bernstein | Market Perform | $200 | Oct 7, 2025 |

| Deutsche Bank | Hold | $200 | Oct 7, 2025 |

| Truist Securities | Buy | $273 | Oct 7, 2025 |

| Roth Capital | Buy | $250 | Oct 7, 2025 |

| Benchmark | Buy | $270 | Oct 7, 2025 |

These targets reflect confidence in AMD’s AI GPU market share and server CPU growth. Overall rating: Buy, with 32 analysts covering the stock.

AMD Price Target 5 Years

Looking to 2030, AMD’s price target could range from $300 to $427, driven by AI chips, server CPUs, and gaming processors. Optimistic scenarios suggest $1,000 per share if inference demand accelerates. Analysts forecast AMD surpassing Broadcom in market cap by 2030, potentially becoming a trillion-dollar company.

Key factors:

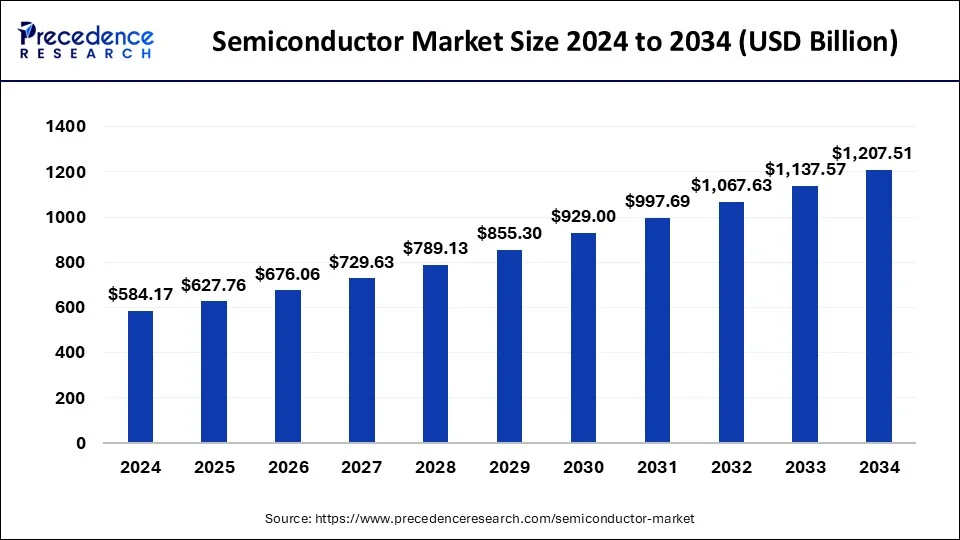

- Market Expansion: Semiconductor market projected to hit $1,207 billion by 2034.

- AI Dominance: $27 billion in AI revenue and $10+ EPS by 2027.

- Valuation: At 30x earnings, shares could triple from current levels.

The broader industry trends support this growth:

Semiconductor Market Size to Hit Around USD 1,207.51 Billion by 2034

Global semiconductor sales are up 22.1% year-to-year in October 2025, with annual growth at 19%.

Is AMD a Good Stock to Buy Now?

AMD presents a compelling case as a buy, with strengths in innovation and market positioning outweighing risks. Pros include undervaluation at 41x 2026 earnings, blockbuster OpenAI deals, and 112% year-to-date gains. SWOT analysis:

- Strengths: Leadership in AI infrastructure (EPYC, Instinct), $5B buyback program, and partnerships with Meta (250k GPUs).

- Weaknesses: High valuation risks if AI spending slows; competition from NVIDIA.

- Opportunities: Expanding into government labs and AI PCs; ROCm software challenging CUDA.

- Threats: Macro volatility and supply chain issues.

X community sentiment is overwhelmingly positive, with targets like $350 by April 2026 and calls to buy dips below $240. Analysts rate it a strong buy ahead of earnings.

In summary, yes—AMD is a good stock to buy now for long-term holders, especially on pullbacks. However, monitor Q3 results for confirmation.

Disclaimer: This article is for informational purposes only and not financial advice. Stock prices are volatile; conduct your own research.