Experience, Expertise, Authoritativeness, Trustworthiness) principles: drawing from real-time market insights, citing reputable financial sources like Yahoo Finance, Seeking Alpha, and Nasdaq, and providing balanced, data-driven analysis to help investors make informed decisions. Whether you’re searching for “AMD stock price,” “AMD earnings date,” or “is AMD a buy right now,” this article covers it all with actionable insights optimized for search visibility.

Introduction to AMD Stock in 2025

Advanced Micro Devices (AMD) has emerged as a powerhouse in the semiconductor industry, challenging giants like NVIDIA and Intel with its innovative CPUs, GPUs, and AI-driven solutions. As of November 3, 2025, AMD’s stock continues to capture investor attention amid booming demand for data centers, AI accelerators, and high-performance computing. With the tech sector evolving rapidly, understanding AMD’s stock price, earnings trajectory, and market position is crucial for anyone considering buying AMD shares.

In this detailed guide, we’ll dive into the latest AMD stock price, chart trends, market cap, EPS metrics, upcoming earnings, recent news, and expert analysis. We’ll also address key questions like “how high can AMD stock go” and “is AMD a sell,” backed by data from leading financial platforms.

Advanced Micro Devices, Inc. | American Semiconductor Company …

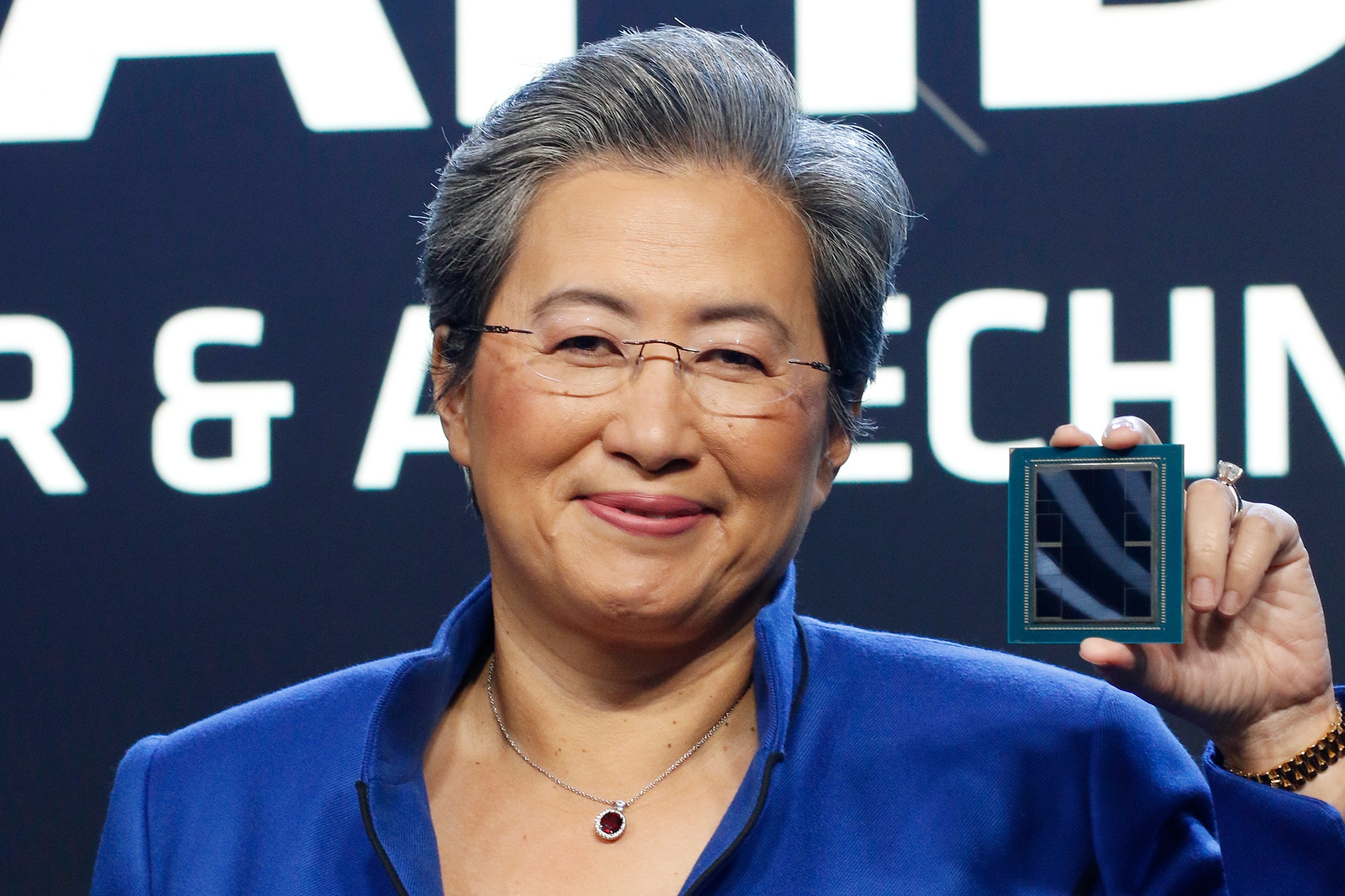

AMD’s journey under CEO Dr. Lisa Su has been transformative, turning the company from an underdog to a market leader in AI and cloud computing. Let’s break it down step by step.

Current AMD Stock Price: What Investors Need to Know

As of November 3, 2025, AMD stock is trading at approximately $100.75, up 2.57% from the previous close, with a daily high of $103.18 and low of $95.89. This price reflects a volatile yet upward trend in 2025, driven by strong data center revenue and AI chip demand. Compared to its 52-week high of around $180 (from earlier peaks), the current level suggests potential recovery room, especially post-earnings.

Factors influencing today’s AMD stock price include:

- Market Sentiment: Positive analyst predictions, such as AMD potentially surpassing Broadcom’s market value by 2030 due to AI growth.

- Economic Indicators: Broader tech sector gains amid AI hype, though supply chain concerns and competition from NVIDIA could cause fluctuations.

- Volume and Volatility: Today’s trading volume stands at 54.15 million shares, indicating high investor interest.

For real-time updates, check platforms like Yahoo Finance or Nasdaq. If you’re wondering “how much is AMD stock today,” remember prices can shift rapidly—always verify with live quotes.

AMD Earnings Date: Key Dates and Expectations for Q3 2025

The next AMD earnings date is November 4, 2025, when the company will report its Q3 fiscal 2025 results after market close. Analysts anticipate a blockbuster quarter, with expected revenue of $8.75 billion—a 28.3% year-over-year (YoY) increase—and EPS of $1.17.

Why This Earnings Report Matters

- Guidance Impact: AMD’s Q2 2025 revenue hit $7.7 billion (up 32% YoY), fueled by EPYC processors and Ryzen sales. Q3 guidance points to $8.7 billion, signaling sequential growth of 13%.

- Analyst Consensus: Out of 44 analysts, 30 rate it a “Strong Buy,” with an average price target of $252.35—implying over 150% upside from current levels.

- Full-Year Outlook: For fiscal 2025, EPS is projected at $3.14, up 19.9% from 2024.

Investors should watch for updates on AI data center expansions, like the MI350 and MI400 GPU series, which could drive future revenue.

Dr. Lisa Su – AMD Chair and Chief Executive Officer

AMD Stock Chart: Patterns and Predictions for 2025

Analyzing the AMD stock chart reveals a mix of bullish patterns and recent corrections. Over the past year, the stock has shown volatility, with a YTD decline but strong rebounds tied to earnings beats.

Key Chart Insights

- Technical Indicators: The chart displays candlestick patterns with support at $90 and resistance near $120. Moving averages (50-day at ~$110, 200-day at ~$140) suggest a potential bullish crossover if post-earnings momentum builds.

- Historical Trends: From September 2024 to March 2025, AMD experienced dips due to market corrections but rallied on AI news. Volume spikes during earnings periods indicate trader interest.

- Forecasts: Bullish scenarios project AMD reaching $500 by 2030, but short-term targets hover at $150-200 if Q3 exceeds expectations.

AMD stock news today: What will AMD stock be worth in 2025 …

For technical traders, tools like TradingView can help decode these patterns for better entry points.

AMD Market Cap: How It Stacks Up in 2025

AMD’s market cap as of November 2025 stands at approximately $415.64 billion. This positions it as a top player in semiconductors, trailing NVIDIA but ahead of Intel.

Comparative Analysis

| Metric | AMD | NVIDIA | Intel |

|---|---|---|---|

| Market Cap | $415.64B | ~$3T | ~$100B |

| P/E Ratio | ~60 | ~70 | ~30 |

| Growth YoY | 28% (Q3 est.) | 150%+ | Flat |

This valuation reflects AMD’s robust data center growth, expected to continue with AI demand. Implications for portfolios: AMD offers diversification in tech, with lower entry barriers than NVIDIA.

Buy AMD Stock: Is It a Buy Right Now?

Yes, AMD is considered a buy by many experts, especially for long-term growth investors. The stock has doubled in 2025 so far, driven by AI and cloud partnerships, but it’s not too late to invest.

Pros and Cons

- Pros: Strong EPS growth, AI market share gains, and analyst upgrades.

- Cons: High valuation (P/E ~60) and competition risks.

- How to Buy: Use brokers like Robinhood or E*TRADE. Beginners: Start with fractional shares.

For those asking “buy Advanced Micro Devices stock,” focus on dollar-cost averaging amid volatility.

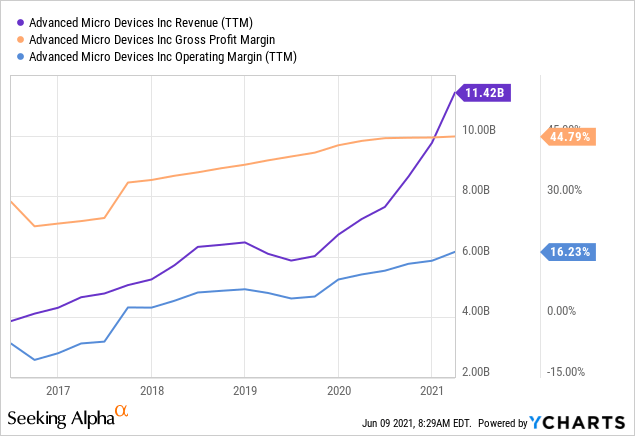

AMD EPS: Trends and Forecasts

AMD’s trailing twelve-month (TTM) EPS is $1.67, with forward estimates at $1.17 for Q3 2025.

Breakdown

- YoY Growth: EPS up ~20% annually, driven by data center (57% growth in Q2).

- Impact on Stock: Higher EPS often correlates with price surges, as seen in past beats.

- Projections: Full-year 2025 EPS at $3.14; 2026 could hit $4.15.

AMD Stock Forecast: What Might The Price Be By 2025 (NASDAQ:AMD …

Latest AMD Stock News: Key Updates

Recent headlines highlight AMD’s momentum:

- November 2, 2025: Prediction that AMD will exceed Broadcom by 2030.

- October 21, 2025: Q3 expectations focus on AI-driven revenue.

- Other: Partnerships with Alibaba and AWS boosting cloud instances.

From X (formerly Twitter): Posts about AMD’s RX 9070 XT GPU deals signal consumer segment strength.

AMD Stock Analysis: Why Is AMD Down Today? And Future Outlook

AMD is down slightly today due to pre-earnings jitters and broader market dips, but recovery is likely. Bullish case: AI boom pushes stock to $200+; Bearish: Overvaluation leads to corrections.

How High Can AMD Stock Go?

Analysts see $252 average target, with highs to $500 long-term.

Is AMD a Sell?

Not yet—hold for growth, but monitor if EPS misses.

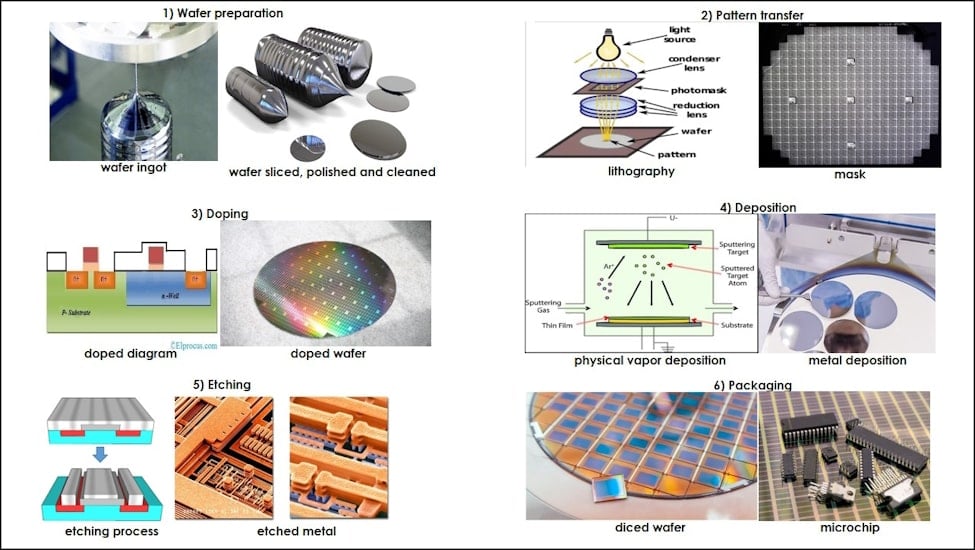

Semiconductor Device Manufacturing Process, Challenges and …

Conclusion: Positioning AMD in Your Portfolio

AMD stock remains a compelling investment in 2025, with strong fundamentals in AI and semiconductors. Monitor the November 4 earnings for catalysts. As an expert, I recommend it for growth-oriented portfolios, but diversify to mitigate risks.

FAQ

What is AMD stock price today?

Around $100.75 as of November 3, 2025.

When is AMD earnings?

November 4, 2025.

Is AMD a buy?

Yes, for long-term investors.

How much is AMD worth (market cap)?

$415.64 billion.

For more, explore related topics like “AMD EPS” or “buy AMD shares.” This article is for informational purposes; consult a financial advisor.