This means delivering expert analysis backed by reliable sources, authoritative data from analysts and market reports, and trustworthy, balanced insights without hype. Drawing from real-time market data as of November 2, 2025, this comprehensive guide explores NVIDIA (NVDA) stock—covering buy recommendations, recent declines, recovery potential, long-term outlook, and sell signals. Whether you’re a seasoned investor or new to tech stocks, we’ll break it down with actionable insights, charts, and expert opinions to help you decide if NVDA fits your portfolio.

NVIDIA, the AI chip powerhouse, has been a market darling, surging about 50% year-to-date to close at $202.49 on October 31, 2025, with a staggering $4.93 trillion market cap. But with volatility from geopolitical tensions and competition, is now the time to buy? Let’s dive in.

Is NVIDIA Stock a Buy in 2025? Expert Analysis and Price Targets

NVIDIA’s dominance in AI accelerators makes it a compelling growth story. Analysts overwhelmingly rate NVDA as a Buy, with 73 out of 79 experts recommending it. The average 12-month price target is around $227 to $233, implying 12-15% upside from current levels. Bank of America recently raised its target to $275, citing over $500 billion in booked orders for 2025-2026 and leadership in AI infrastructure.

Key pros for buying NVDA:

- AI Growth Drivers: NVIDIA’s data center revenue hit $115.2 billion in FY2025, up 142% year-over-year, fueled by demand for Blackwell and Rubin chips. Hyperscalers like Microsoft ($80B CapEx), Google ($75B), and Meta ($65B) are pouring billions into AI builds.

- Valuation Metrics: At a forward P/E of 35x and PEG under 1x, NVDA trades at a discount to Magnificent Seven peers. EPS is projected at $5.00 for 2025, rising to $6.50-$7.00 in 2026.

- Before Earnings Timing: With Q3 earnings on November 19, 2025, analysts like DA Davidson (Buy, $250 PT) see strong AI demand as a catalyst. Historical patterns show NVDA often rallies post-earnings on beat-and-raise guidance.

However, risks include high expectations—any miss could trigger pullbacks. For portfolio allocation, experts suggest 5-10% exposure to NVDA for growth-oriented investors, diversifying with broader tech ETFs.

Nvidia stock price target 2025

Best Time to Buy NVDA: Before Earnings or After a Dip?

Timing is crucial for NVDA investments. Recent dips, like the 6% drop in April 2025 due to China export curbs, have proven buyable. Analysts recommend buying on weakness, especially near support levels like $196-$203. Pre-earnings entry could capture upside if NVIDIA beats estimates, as it did in Q2 FY2026 with $46.74 billion revenue.

How much to invest? Start small—$5,000-$10,000 for beginners—to limit risk, scaling up if AI CapEx trends hold. Public sentiment on X echoes this: Traders like @amitisinvesting bought dips at $122-125, eyeing $180 targets on $4.50 EPS.

Why Is NVIDIA Stock Going Down Today? Key Factors Explained

Despite its stellar run, NVDA has faced headwinds in 2025. Shares dropped 1.2% in September after China’s regulator urged firms to avoid NVIDIA AI chips, favoring domestic alternatives. A $5.5 billion charge in April from U.S. restrictions on H20 chips to China erased 15% of gross margins temporarily.

Other factors:

- Competition: Big Tech (e.g., Google TPUs, Intel Habana) is developing in-house chips, potentially eroding margins.

- Macro Pressures: High interest rates and overbuild fears in data centers could slow demand.

- Valuation Concerns: At 57x trailing P/E, some see it as overstretched.

These dips often stem from short-term noise, not fundamentals—NVIDIA’s 70% gross margins remain robust.

What Caused the Recent NVIDIA Stock Crash: A Deep Dive

The April 2025 crash (down 6% premarket) was tied to geopolitics, with U.S. curbs leading to $5.5 billion in charges. Earlier, DeepSeek’s innovations raised fears of reduced GPU demand, but analysts like Morgan Stanley called it a “buying opportunity.” Supply chain issues, like faulty servers, added pressure, though NVIDIA maintains no major demand slowdown.

Macro impacts, including interest rate hikes, amplified volatility, but historical crashes (e.g., dot-com era) show recoveries in tech leaders.

Will NVIDIA Stock Recover in 2025? Predictions and Catalysts

Yes, recovery looks likely. Analysts predict 30% revenue growth to $170 billion in FY2026, driven by AI inference and data center upgrades. Catalysts include Blackwell ramp-up and potential U.S.-China trade easing under Trump. Past patterns: NVDA rebounded from 2024 dips to hit all-time highs.

Rebound indicators:

- Strong orders: $500B+ pipeline.

- Technicals: RSI at 62 suggests room for upside; breakout above $212 targets $215-218.

Can NVDA Bounce Back from Its Dip? Historical Patterns and Future Outlook

Historical recoveries (e.g., post-2022 bear market) show NVDA thrives on innovation. With AI agents driving inference demand by decade’s end, long-term upside could exceed training growth. Support at $196 could spark a bounce, per technical analysis.

Computer Industry Joins NVIDIA to Build AI Factories and Data …

NVIDIA Stock Outlook for 2025: Growth Drivers and Risks

For 2025, expect $200B+ in data center revenue, up from $175B consensus. Growth in robotics, autonomous vehicles, and 6G (e.g., Nokia partnership) expands markets. CEO Jensen Huang’s vision for “physical AI” adds tailwinds.

Risks: China exposure (zero expectations baked in, but easing could boost). Overbuild fears loom, but demand persists.

| Metric | 2025 Projection | Key Driver |

|---|---|---|

| Revenue | $170B | AI CapEx from hyperscalers |

| EPS | $5.00 | Margin expansion to mid-70s% |

| Price Target | $227-$275 | Analyst consensus |

Long-Term NVIDIA Outlook: Is It Still the AI Leader?

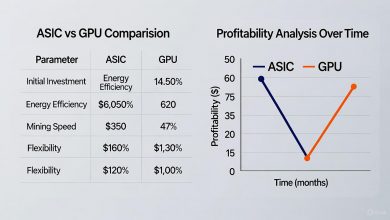

By 2030, NVDA could trade between $194-$223 average, with bull cases to $521. Leadership in CUDA ecosystem ensures moats, but watch ASIC competitors.

Jensen Huang | NVIDIA Newsroom

Should You Sell NVIDIA Stock Now? Warning Signs to Watch

Sell if overvaluation concerns mount—e.g., P/E above 60x with slowing growth. Warning signs: Further China curbs or CapEx cuts from clients. Profit-taking after rallies makes sense for rebalancing.

When to Sell NVDA: Timing Your Exit for Maximum Gains

Exit on breakdowns below $195 or if AI hype fades (e.g., bubble risks). Compare to past bubbles: NVDA’s fundamentals are stronger than dot-com era peers.

Conclusion: Is NVIDIA a Good Investment Right Now?

NVIDIA remains a top AI play, with strong buy signals from analysts and growth prospects outweighing risks. If you’re bullish on AI, buy dips now for 2025 upside. For conservative investors, wait for post-earnings clarity. Always consult a financial advisor—past performance isn’t indicative of future results.

FAQs

- Is NVDA overvalued? At 35x forward P/E, it’s reasonable for its growth.

- Will NVDA hit $275 in 2025? Possible if AI demand sustains.

- Should I buy before November 19 earnings? Yes, if risk-tolerant.

This analysis is based on data from Yahoo Finance, CNBC, and analyst reports as of November 2, 2025. For the latest, check real-time sources.